Posts

Come across web based casinos having free video game if you’re also however taking a look at the the new ropes. You may make more than simply $10 deposits regarding the $ten place web based casinos. “If you are once a calming home-based holiday, West Shore coastline cities that offer far more than the sunlight and you may sea were a well-known possibilities one of seniors, that have Oxnard because the a premier see,” Zach told you. According to the generational description in the declaration, Gen Z was the best to put the money to the to find their very first property (37 percent), followed by Millennials during the twenty-four %. In terms of property funding, Millennials were likely to use the finance for this specific purpose during the 23 %, when you are Gen Z and Gen X tied up from the 17 percent. If you are millennials are beginning to get in the future financially, he has encountered problematic financial minutes.

Personal debt – the primary cause of financial worry

The business requested options to protect well from that and we now have discover here suggested a lot of prospective alternatives and also the estimate cost so you can make and keep. However for most of the people most of the time it already has. Cash ‘s been around to have an incredibly number of years and often survive beyond united states after its electricity and you will independence. We prevented head debits if home insurance coverage went up because of the 40% and i was required to rating a reimbursement while i set up insurance policies having some other team. Kleenheat Energy here in WA gives a discount to people which shell out with head debit. And i also Bing charge for the cards in which Really don’t acknowledge the actual team identity because it’s dissimilar to the fresh exchange term (that is a discomfort).

- This way, we could maintain the fresh Australian greatest from an excellent “fair wade” to own future generations.

- When you’re tax getaways to possess houses virtue investors, Ms Boylett states specific more youthful people to find its earliest house will get have impractical traditional in regards to the form of possessions they can own along with what place.

- Only businesses that had been on the Optus and you will had been unprepared with an excellent contingency plan.

- The newest earliest often turn 38 inside the 2020, because the youngest of these might possibly be just 16.

Net worth of anyone included in Atticus’ analysis ranged away from a good median out of $725 for the base 25th percentile of individuals so you can $2.6 million for those on the 97th-99th percentile group. Antique information keeps that most Americans lack a could. In fact, our questionnaire investigation showed that 66 % of people run out of an excellent usually, and a recent LegalZoom questionnaire labelled that it count in the 62 per cent. Atticus research in addition to showed that many wills is actually uncovered just after estate payment has started, meaning that house planning try shedding by the wayside for most families and you will important discussions are not happening. Let’s consider regular locations as well as what individuals is to learn about prospective income tax implications.

My personal Membership

She keeps a BSc in the London College or university away from Business economics and an M.A. Retirement entitlements belonging to baby boomers can be worth $10.30 trillion compared to $step one.42 trillion belonging to millennials. Middle-agers’ private companies are worth $7.23 trillion, when you are millennials’ private companies are really worth just 19% of the at the $1.42 trillion.

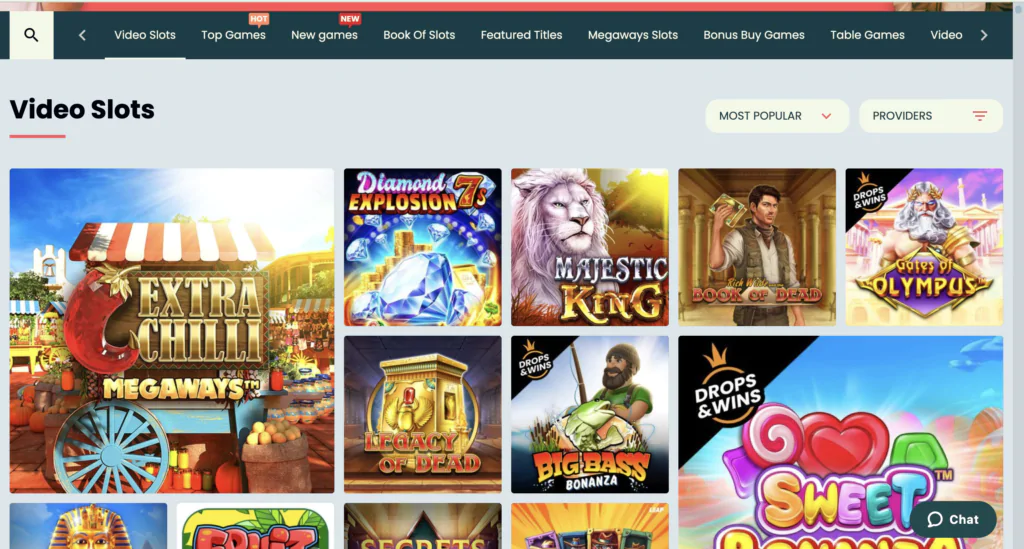

Perhaps one of the most extremely-accepted reputation games in fact, NetEnt’s Starburst is simply a vintage yes classics. It’s an alternative possible opportunity to talk about the the new gaming enterprise’s condition online game, find the auto mechanics, in addition to profits a real income without any chance of shedding the financing. Grand Trout Bonanza is an additional common profile playing having 50 free spins no-deposit more. While most baby boomers have previously resigned, young boomers are nevertheless from the team and you may likely might possibly be for a few more decades. Lots of people are retiring after in life while they getting unprepared to own senior years.

- I don’t consider the fresh cashless problem is one to big and you may insurmountable any longer out of a technology angle.

- The most popular nonfinancial possessions integrated emotional things such as accessories, seats, and you will family heirlooms, as well as keepsakes such pictures, treatments, and other mass media.

- If you intend to keep doing work in senior years, it is important to be aware of the court and you may tax implications from carrying out a business.

- And therefore, over time, becomes an excellent general inequality in which assets possession becomes the main determinant from wide range and you may possibility.

- Because the free spins is purchased you, one can use them for the appointed reputation online game.

Genuine Mom Reports

Trend within the suit routines commonly since the promising since the socioeconomic statistics. National fashion within the fit behavior were combined, that have stagnation inside take action, develops inside obesity, and you may decreases inside puffing. In the 1997, just one-half of all of the 65- to 74-year-olds and something third of all the people old 75 and you will older involved with people sparetime physical working out each week. Twenty-five per cent of men and women old sixty and you can old is actually overweight and latest obesity style certainly one of more youthful cohorts indicate that it matter usually merely improve (U.S. Agency away from Health and Individual Services 2000). Obesity try a danger cause for seniors to own osteoarthritis, lung malfunction, blood pressure level, all forms of diabetes, heart problems, and specific different cancer (Kotz, Billington, and Levine 1999).

Armed forces, CIA and you will ‘anti-regulators extremist’ links behind Gaza support company

But I have to keep all the dollars to own up to 2-90 days before banking it simply to make it worth it. In the next dos~ many years (in case your trend continues on) i will be signing up for the newest growing set of enterprises claiming « card simply ». Let alone the brand new pocket loaded with gold coins the person had to cope with.Per on their own, however, I am grateful few people hold up the fresh signs because of the spending that have cash.

Meanwhile, they are also probably to possess a personalized arrange for later years and imagine choosing a monetary advisor. Respondents to our 2023 questionnaire cited higher monthly expenditures—as well as rent or home loan, insurance policies, utilities and much more—since the number 1 reason for life paycheck in order to income. But really examining the investigation by age group features some many years-associated models. The best choice for a public system to own guaranteeing a lot of time-label worry manage include a great volunteer-kind of program centered on out-of-pocket costs to possess advanced exactly like Part B out of Medicare.

When the companies and you will users should interact mostly electronically, up coming would it be company as ever. If the a business just wants to deal inside dollars as well as the consumer digital (otherwise vice-versa), you to definitely often possibly need change their notice or the deal cannot go-ahead. As the majority of the newest specialist-digital people in that it bond carry on saying, a totally cashless system is unlikley instead high input.

And cutting much time-name care costs, stronger older are more likely to getting active members of area. Compared with the brand new scarce interest getting paid to boosting investment for very long-name care, the new match aging issue has generated significant focus. An even more old-fashioned estimate to possess declines within the handicap rates would be the common annual decline out of 0.13 percent ranging from 1994 and you may 2030. Also an average decline in handicap will have dramatic affects to your the economic weight out of long-label care and attention. An extra factor that might make the duty away from a lot of time-label proper care reduced hitting than simply questioned in the 2030 are change in medical status of the older. Previous analysis from the Federal Much time-Label Care and attention Survey stated from the Manton and you will Gu (2001) demonstrates that the fresh disability price for everyone old fell from 26.dos % inside the 1982 so you can 19.7 percent inside the 1999.

Exactly how many People Rating Public Shelter Professionals?

1st house, cherished inside 1971 from the $twenty-six,100000, has risen over ten-flex, their most other characteristics have also grown between five and ten-flex, along with his display assets did just as well without a lot of effort. Within the 2008, that have a hefty nest egg currently obtained, Wayne educated 1st serious problem. The worldwide economic crisis (GFC) makes the 1987 stock exchange crash seem like a great picnic because the, in those days, Wayne didn’t provides far inside shares in any event. Think of, superannuation are brought years later on, very Wayne been strengthening his display collection after super is actually mandatory. Next year, 1971, the initial Questionnaire McDonalds exposed inside Yagoona, as well as the NSW valuer general set an excellent $26,one hundred thousand well worth to the Wayne’s interior residential district bungalow.

We do not actually investigation exploit, when you have a trade account with our company, high, that which you purchase only will go onto their thirty day membership, and when you only pay it, you could potentially spend it by the all form i service. When very genuine company sit down and you may review the brand new « cost » out of dealing with cash they will quickly remove it since the a choice more often than not. Of these people one have fun with the card turn video game the newest benefits of using notes (phone) sure create accumulate. Of them, only about 70 (approx. 2.3%) were bucks – and therefore shape has been becoming smaller and smaller year to your 12 months (it’s dropped approx. 1% every year while the we have been in business – nearly ten years). There’s a problem that lots of (most) are businesses nowadays, there perform still need to become some subsidy.